Getting Dibs on (MA) Bids - Part 2

A Medicare Advantage (MA) insider explains how MA executives use a basic profit formula to inform strategies designed to outperform their competition

Context

This is Part 2 of a 3-part “interview” series designed to help digital health leaders at startups and larger companies better understand current and prospective MA plan customers and their likely needs. In Part 1, which I recommend you read first, the interview provides some context on the MA bid process which is so central to company strategy and performance. Today in this post, we break down the core financial formula that MA organizations use as a framework to make strategic choices, and outline a few examples. And in Part 3, we will get into the “so-what” as it relates to how best to use this information so as to be a better partner.

As reminder, I use quotation marks above around “interview” because the interview is with an imaginary MA executive, Susan Moop. Just like Part 1, the conversation is fictional, but the content is informed by executives with real profit and loss and benefit design management experience, and the content of the interviews was edited by them.

For some readers who are MA insiders/experts, you may find some of the content rudimentary and maybe even boring. However, this series may not really be for you. This is written for the large majority of folks trying to better understand how Medicare Advantage works. For these individuals and teams, sometimes a plainer-english primer provides a jumping off point to refine their understanding of a business that is not broadly well understood.

Onto Part 2 of the interview with Susan!

Medicare Advantage composite financial performance over the last 5 years

Source: Milliman, Inc. “Medicare Advantage Financial Results for 2021”

Part 2 Highlights

Underwriting margin is the key financial formula that MA organizations use to frame how they approach competitive differentiation and strategy during MA bid process.

The MA plan can employ several different levers so as to improve its total underwriting margin so that it can use those dollars to reinvest back into better benefits or lower member cost share.

Delivering high quality care, as measured by a plan having a Star Rating higher than 4, has been shown to have direct influence on outsized growth.

Network contracting has largely been a mechanism that larger organizations can use to secure an advantage over its rivals in terms of savings.

Each year clinical program teams at MA plans look for new innovations that can deliver measurable impact on total cost of care. These programs can include services like utilization management or care management, technology tools enabled for providers, or value-based contracts, among many others.

The more savings that can be actuarially booked year over year, the more aggressive the MA organization can be in pricing its products by providing more benefits and lower copays. The more aggressive the products can be priced, the better chance the MA organization can grow more sustainably than its competitors.

All of these efforts become even more complicated when the Medicare Advantage organization has risk-contracts with primary care physicians.

Susan is a good sport when it comes to her last name!

Introduction

We are excited to share Part 2 of our interview with Susan Moop. As a reminder, we interviewed Susan, one of the pre-eminent experts on MA in the country, for an insider perspective on the MA bid strategy and planning process. The MA bid process is among the most consequential business processes in US health care, funding the care for over 28 million Americans and accounting for $427B1 in federal expenditures. As a federal program administered by Centers for Medicare & Medicaid Services (CMS) with a highly regulated annual cycle, the bid process is highly structured, the inputs are well studied, and the blind auction submission offers some drama that caters to eager game-theorists. Understanding the process, why it is important, and anticipating challenges and opportunities MA plans and their risk-bearing provider partners face can offer rich insights for digital health entrepreneurs to harness in their sales efforts with MA clients.

Interview - Part 2

TheTreatmentPlan: Welcome back Susan! We got a lot of great feedback from Part 1 of the discussion, and we are glad you were willing to spend more time with us. Notably, readers commented “can’t wait for Part 2!”. And not surprisingly, you did in fact draw the largest readership of any TheTreatmentPlan post to-date, and subscriptions to this Substack increased by almost 40%.

Susan Moop: 40% of a small number is…

TheTreatmentPlan: Sometimes I forget that you are a numbers person. Let’s move on. I know folks are interested in more strategic insight into MA plan strategy, but before I dive into that I have to ask you about your last name, “Moop.” That is pretty unique?

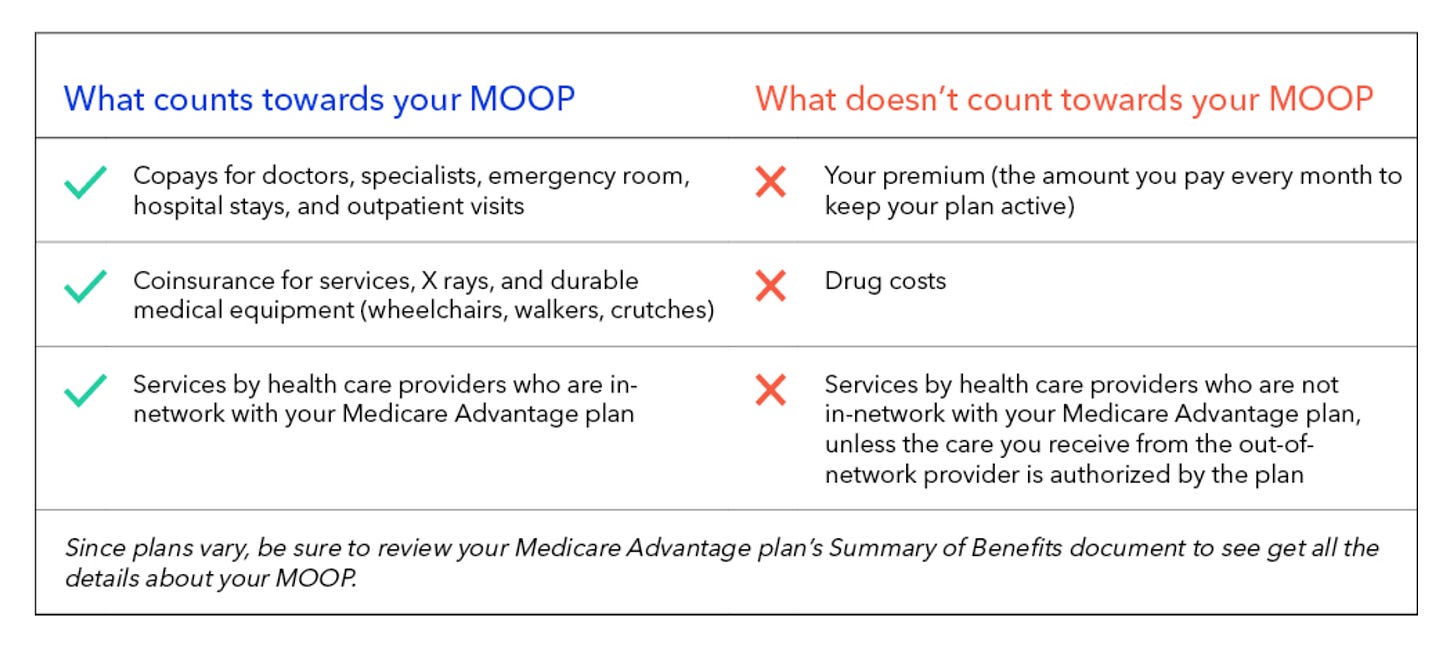

Susan Moop: I get asked about my last name a lot for 2 reasons. First, it is not very common, as you mention. I am not really sure of the origin of Moop. Some say names can have linkages with professions in history? This is related to the second reason I get asked about my name. For those of your readers with Medicare Advantage experience, they may have already had a laugh. “M.O.O.P.” also happens to stand for “Maximum Out Of Pocket” and in many circles it is actually enunciated as “moop” and not as an acronym. Here is a good piece from Oscar Health that explains what MOOP is for those interested.

Source: Oscar Health, “What’s a Medicare Advantage MOOP?”

TheTreatmentPlan: Maybe the MA profession is centuries old!? I can imagine that the joke gets old given how often terms like MOOP get discussed in sales meetings.

Susan Moop: Yes, you could say that.

TheTreatmentPlan: Getting back to business, in our conversation from Part 1, I found it helpful that you simplified the game theory examples so as to help me and TheTreatmentPlan readers understand the process. But to some extent it is pretty important to understand some of the complexity given that in practice the competitive dynamics are much more nuanced. Can you share a bit about the different advantages/weaknesses that different health plans might enjoy/suffer that make the game theory analysis more complicated?

Susan Moop: Sure. Maybe the easiest way to break down the advantages different organizations can exploit is to distinguish between what is the same across all MA plans in a given geography and what is different. First a framework might help make this easier to understand. As a finance person, I like to use formulaic structures to help simplify problems and facilitate problem solving. In this case a helpful framework is the formula for MA underwriting margin. Underwriting margin is a function of total members times the per member underwriting margin. Per member underwriting margin is a function of premium per member less medical costs per member. Note for the purposes of this conversation, I am leaving out technical elements of the underwriting margin / medical loss ratio formulas that insurance regulators include in the standard definitions such as administrative expenses.

In each element of the underwriting formula, there are aspects that are shared by each plan. All plans in a given county are subject to the same age-in trends, consumer needs/preferences, available network partners, benchmark rates, provider market power, and utilization trends.

These similarities help make clear the opportunities for differences that can be a function of organizational focus, size/scale, and short term tactical decisions. In terms of top line, Quality, and specifically Star Ratings, can give a plan a huge revenue advantage over competitors without such bonuses. Brand, consumer intelligence and sales distribution enables plans to reach prospective members differentially. Broader product portfolios, or multiple different types of plans designed to address the needs of specific segments can attract purchasers whose needs are better met for that specificity. And MA plans that include benefits that best attract specific segments of beneficiaries can outperform. A more recent trend related to growth is something that you have written about quite a bit. With all the competition in risk-bearing primary care medical groups, they are increasingly investing in growth in ways that historically only MA plans did. This investment can benefit those MA plans who have partnerships with such groups.

On the bottom line, network contracting is employed to create competitive differentiation. The obvious one is negotiating better hospital and physician rates, but contracts with globally capitated primary care physician groups would also present an advantage given the guaranteed underwriting margin these contracts offer. Last is clinical programming. Clinical programming represents a wide variety of internally managed and externally vended programs designed to improve outcomes and reduce inappropriate total cost of care.

TheTreatmentPlan: Ok, this makes sense, but I think it may help to go more deeply into a few of these. Can we pick a few? I promise to leave out provider documentation/risk adjustment.

Susan Moop: Thank you. That one is getting is probably getting enough attention these days.

TheTreatmentPlan: More and more evidence is being published that is showing the quality benefits of MA relative to traditional Medicare. To that end, can you talk about Star Ratings? What does it mean to have an advantage there, and how does that relate to the bid process?

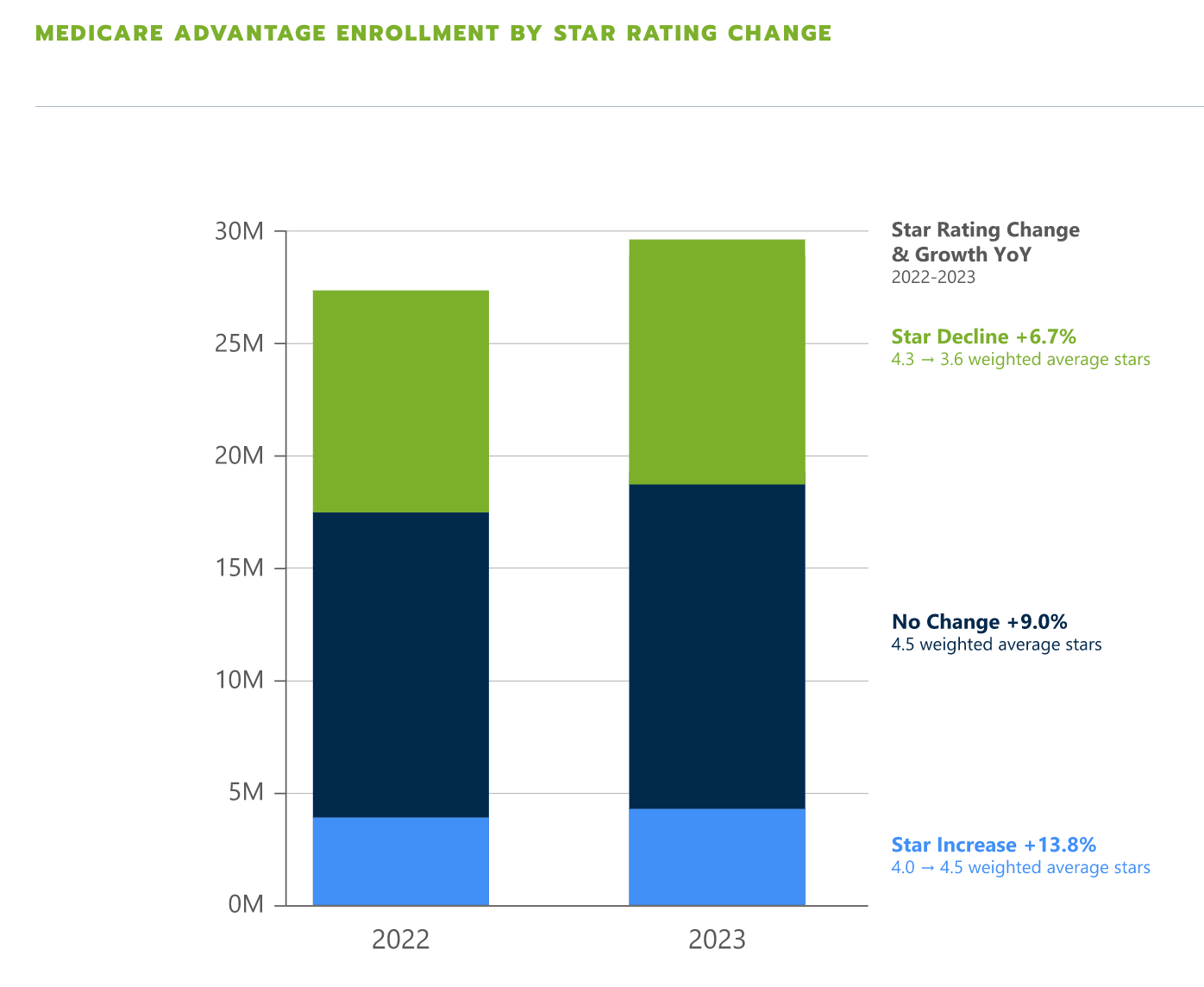

Susan Moop: Star Ratings is a great one to discuss. In most counties, achievement of 4 or more Stars out of 5 earns the MA plan a bonus of up to 5% of premium. What that means is that if a plan will earn such a bonus in 2024, and its competitors will not earn such a bonus, it knows it has 5% more revenue with which to work. This is a large amount of money when you think about the overall margins of an MA plan. To that end, the organization can decide to keep as much of this as possible as profit, or it can reinvest those dollars back into benefits in a way that will build more attractive product offerings that can generate the same underwriting margin as its peers with less attractive plan designs. This structure creates a great feedback loop. Plans that invest in quality can deliver better outcomes, they are rewarded for those investments, and then they reinvest those rewards back into benefits for members in ways that keeps health care coverage more affordable and/or offers more coverage. The data are pretty compelling on this. Just last week Chartis in its 2023 Medicare Advantage Competitive Enrollment Report shared that in 2023, MA plans that had Star Rating improvement saw 2X the enrollment growth of plans that saw Star Rating declines.

The other great thing about achieving the highest possible Star Rating performance of 5 Star, is that you can market your plans all year round. Plans with Star Ratings of less than 5 Star can only market their plans from October 1 through the end of the Annual Enrollment Period end date of December 7. Here is a link to the CMS press release identifying, among many other things, 5 Star Plans for 2023.

TheTreatmentPlan: So MA plans with this quality advantage can continue to invest more relative to their peers. Quality pays. What a concept! Let’s look at one or two others. How about network contracting? How can a plan use that to its advantage?

Susan Moop: Network contracting is an age-old tactic in health insurance and is generally associated with the fractious relationship between provider organizations and health plans. However it is particularly nuanced in Medicare Advantage because contract negotiations are not isolated by line of business. What I mean by this is that even if I am a plan with a small Medicare Advantage business in a specific county, if I have a large commercial business line, I may actually be able to negotiate more favorable MA rates than organizations with much larger MA market share, but no commercial business.

TheTreatmentPlan: Got it. So a BCBS plan or an Aetna/United/Cigna might be able to secure better Medicare Advantage rates with local hospitals than other locally strong MA plans purely because of the strength in the aforementioned plans’ commercial business. This obviously favors the larger and more diversified organizations.

Susan Moop: Historically yes, but things are starting to shift. As the movement to risk accelerates and we see more risk-bearing primary care groups, in many ways their contracts become as important as those with the hospitals. And interestingly, many of those plans with strong Commercial market share and focus on PPO networks often have not invested in the infrastructure necessary to make it easy/advantageous to contract in risk arrangements in Medicare Advantage. This gap relative to the more progressive MA plans has put such organizations at a disadvantage in a value-based payment world.

TheTreatmentPlan: Interesting. And those full risk contracts lock in a guaranteed profit margin if those contracts are designed as percentage of premium. Perhaps this is one of the reasons that Humana seems to have abandoned its Commercial business and doubled down on Medicare Advantage?

Susan Moop: I don’t have inside knowledge of the situation at Humana but that would make sense. Humana is operating from a point of disadvantage in certain markets with hospitals who have better rates with other plans, but if you can make up the difference in Star Ratings impact, risk-bearing PCP contracts, and clinical performance improvement programming, perhaps in the future you don’t need to have the most leverage over hospitals to be the most successful. It also helps that focus is the name of the game these days.

TheTreatmentPlan: That is interesting and puts into more clarity into the strategy that startups like Devoted Health have focused as well as where other clinically enabled regional plans have been making headway. Can we also go into one more area of detail? You talked about clinical programming. Say more?

Susan Moop: Clinical programming is the area I enjoy the most because it is basically where a Medicare Advantage organization taps its physician and other clinical leaders to scour the evidence and the innovations that are in the marketplace to come up with ideas that can improve quality and decrease unnecessary costs of care. The way to think about it is that the actuaries will come to me and say “our medical trend is running at X% going into next year.” And then we can convene a cross functional group and ask the question “what are some ideas we could employ to decrease that trend by some amount?” In some organizations this group actually might be called a “Trend Committee” and some organizations call the ideas “trend benders”. While the committee names and projects might have different nomenclature from MA organization to organization, the process is the same.

TheTreatmentPlan: What are some examples of these programs? And can any hair brained idea get funded?

Susan Moop: These programs can span across multiple different teams and disciplines. Trend improvements can come from programs or innovations in utilization management, care management, provider engagement, network, analytics and others. To get into a little more detail, if the MA plan saw that it was experiencing highly variable costs and outcomes in cancer treatment, it could decide to set up a center of excellence program that would incentivize treatment to occur at specific organizations with which it secured a value-based contract. It would project a level of savings to occur as a result of this change, and this projected change in cost would get booked as a trend impact for 2024 medical expenses. It could then use these savings to reinvest back into benefits and/or lower member cost share.

Another example could be an investment in a set of tools and dashboards designed to help primary care practices refer to high performing specialists. Here again, an estimate would be made on how many members would have their care pathways improved and what dollar impact that improvement would deliver. Those savings would then be booked and potentially reinvested back into member benefits.

TheTreatmentPlan: One thing that I did not completely appreciate was how important the projection of the trend results was relative to the actual performance.

Susan Moop: Correct. In other industries you might have an investment idea with a projected value, the projection serves more as an estimate for resources and a benchmark for ROI and other elements of performance. In a MA plan, the projection for savings is a hard dollar amount that is effectively filed with CMS. The results need to be rigorously supported, and obviously the investment case needs to be presented/accepted in time to be incorporated into the bid strategy process we discussed in Part 1. And then once the program is put into place, it needs to be implemented, managed, and optimized so as to achieve the performance. If performance falls short, then the MA plan needs to 1) employ mitigation plans in that program area that offset the shortfall, 2) generate higher savings in other programs, or 3) be satisfied with higher than planned medical expense ratio. Number 3 is generally an unacceptable outcome.

TheTreatmentPlan: How do these clinical programs relate to those MA plans with full-risk primary care physician groups (PCP). Aren’t those entities at risk and therefore the purchaser of these programs?

Susan Moop: Full-risk PCPs complicate the analysis and the implementation. As you state, for any clinical program that improves total cost of care, it does so for the entity that is taking the risk for that cost of care. So for those members where the MA plan is at risk, the plan pays for the program and benefits from the cost improvement impact. For those members who have a full-risk PCP, participation in such programs would benefit the PCP. But it would also need to be paid for by the PCP. Different health plans have different philosophies and policies related to these circumstances, but in general the risk-bearing PCPs need to opt-in to such programs. This complicates the process to secure buy-in, funding, and implementation.

TheTreatmentPlan: Yes, I remember when I worked for a risk-bearing PCP, when we reviewed our financial reports we questioned some of these obscure sounding programs that we were paying for but never had the chance to vet ourselves. We never really felt like we were the customer, and while we knew exactly what the programs cost our medical group, evidence on the value delivered for our patients was difficult to ascertain.

Susan Moop: Yes, it is a tricky area. The insurer is almost always going to be able to secure favorable costs for programs given their economies of scale. However, there are a few problems. First, as you mentioned, the primary care organization often is not part of the buying process. Somewhat similar to how self-funded employers feel about the programs they get from their carrier/Third Party Administrator. Second, the ROI formula over hundreds of thousands or millions of lives may be reasonable, but in smaller populations managed by individual PCP groups their risk pools may not resemble the insurer as a whole. Last, many of these high octane primary care groups actually invest in a lot of similar programs themselves. Oak Street is a good example given how easily it is to see their capability set. It probably isn’t easy for Oak Street’s MA plan partners for those plans to argue their programs are better suited to deliver medical cost impact than the work Oak does themselves

TheTreatmentPlan: Got it. So for plans with a significant focus on full-risk primary care, the process to put in a new clinical program is even more complicated. I bet we could do an entire post on this and go deep in the weeds but I want to avoid that. To that end, this is maybe another good place to pause before Part 3 so we focus on keeping the conversation high-level enough, but also useful. Can I convince you to stick around and ask you to put yourself in the shoes of someone trying to provide solutions that help you achieve your medical cost trend objectives?

Susan Moop: Yes! We need more good ideas and perhaps I can help make it easier for folks to crack the code.

TheTreatmentPlan: Great. Readers - stay tuned for Part 3, where we will break down how you can anticipate the needs of prospective and existing MA customers as they plan to compete in the bid process and develop mitigation plans when bid expectations fall short of reality.

Thanks to Kevin O’Leary from Health Tech Nerds for sharing feedback on this post.

https://www.kff.org/medicare/issue-brief/medicare-advantage-in-2022-enrollment-update-and-key-trends/