Medicare Advantage: (Health Plan) Friends with Benefits

Success in Medicare AEP is heavily dependent on how well the health plan tailored its benefit designs for its customer base.

TL;DR Medicare Advantage Marketing, Sales, and Operational delivery tactics are in the news and important drivers of retention and growth of members. However Medicare beneficiaries primarily shop based on the benefits available relative to the cost of those benefits. Changes in consumer expectations and preferences, along with the growth & profitability of the Medicare Advantage market have made winning the plan design strategy the key most important activity health plans undertake each year.

Medicare AEP season: sales execution and politics

If you are younger than 65 and/or not disabled, or if you do not care for someone who is 65+ or disabled, or if you are not a nerd with a lot of Medicare focused keyword searches in your browser history (like me), consider yourself fortunate. You are among the lucky few not being targeted with information about making good choices in your or your loved one’s Medicare coverage. For reference, it is almost like an election every year (yikes). Emails from CMS, snail mail from insurance carriers, non-stop infomercials from tele-brokers: it is a flood of information during the narrow Annual Election Period (AEP) from October 15-December 7 each year when Medicare Advantage plans and related entities are allowed to market their wares.

*Note to CMS - While my birthday is coming up, I am still a couple decades away from Medicare eligibility…

Regardless of your age and caregiving status, you probably have seen a ton of articles raising concerns about Medicare Advantage sales tactics or coding programs, press releases from insurance companies heralding their Star Ratings and new plans/benefits, billboards over the highway, and maybe even some sign spinners outside shopping center plazas. If the geopolitical, economic and political ills in 2022 were not enough to worry about, it feels like the universe is sucking our mindshare into a topic almost no one likes to think about: health insurance.

Health insurance is banal. However, for those making Medicare coverage decisions, and for those working to improve the future of health care in the US, this is a critically important arena to understand. Medicare is one of the few areas of US health care where highly competitive organizations’ economic interests are tightly connected to the needs of individual consumers. If we can empower consumers to drive change, maybe we have a chance to address Medicare’s status as the fastest growing cost segment of all national health expenditures, or 6.8% a year between 2025-2030, and avoid bankrupting the country.1 And if we can make Medicare work maybe we have a chance of fixing commercial in the next 100 years….

Medicare decisions are primarily influenced by benefit design

In my last post I shared that quality ranking, or level of ⭐⭐⭐⭐⭐, was not the principal factor that determines whether an individual will purchase one Medicare plan over another. In 10 years working with really great sales agents, SHIP advisors, Medicare Advantage plan executives, and Medicare beneficiaries themselves, I learned what matters most to older adults during the Medicare AEP.

In which plan will my out of pocket expenses be lowest for the coverage I need

Whether my doctors, and the doctors I might expect to see, are in network

To what degree the MA plan has a good and stable reputation in my community - with my friends, my doctors, and other people I trust

Whether there are new/supplementary benefits available that may help me save money or live better

Whether the Star Rating is high (although there is some correlation with #3)

These factors were substantiated by new research out of the Commonwealth Fund published this month. Notably, for those who choose Medicare Advantage, 44% indicated that “more benefits” or “out-of-pocket spending limit” were the main reason they chose their coverage.2

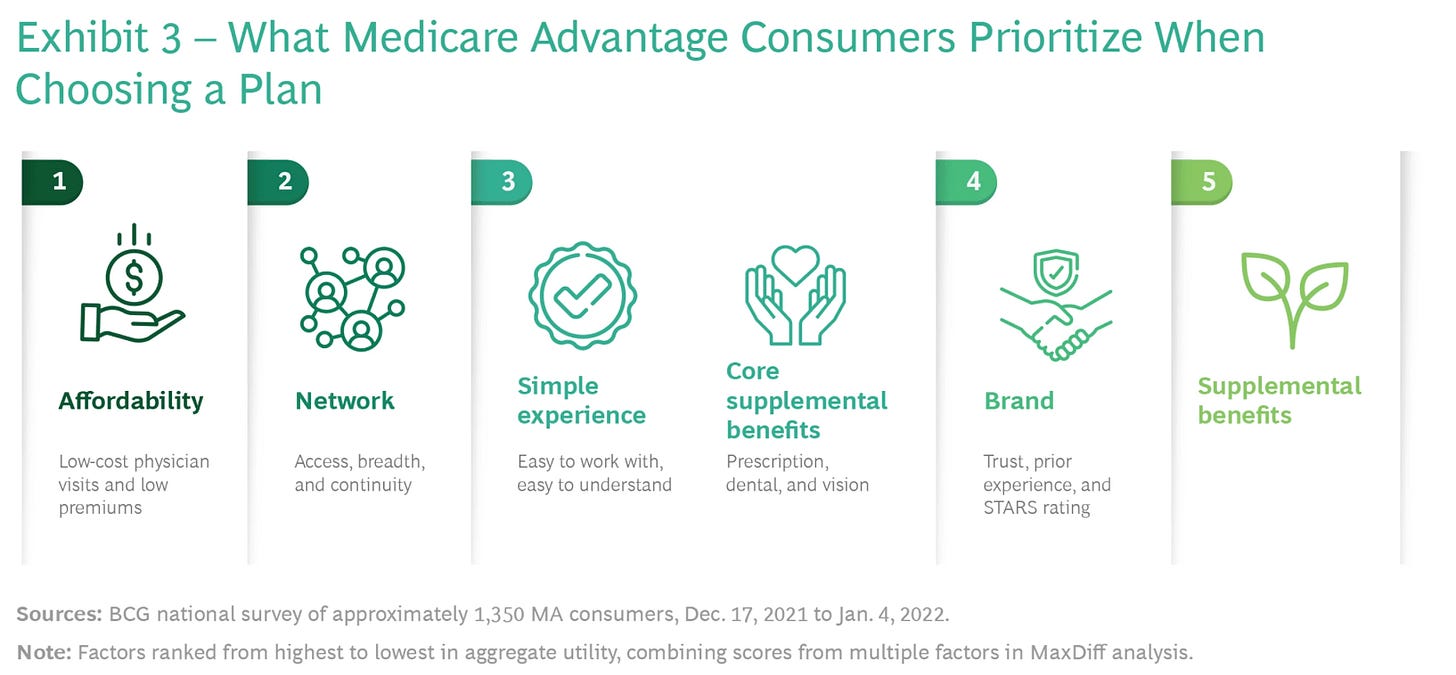

BCG3 did a research study in early 2022 and found similar results when interviewing Medicare Advantage customers. However, the BCG study noted the importance of network to the Medicare Advantage purchaser. While affordability is #1, networks is #2.

BCG’s analysis was interesting in that it recognized that consumer behavior was/is not uniform, and can likely be broken out into many segments. They identified 4 main personas.

“Value Seekers” - The 30% of the market who value affordability. 80% of these choose MA plans.

People who like “all the extras” - The 10% of the market who value benefits that help them live successfully from day-to-day. 60% of these choose MA plans.

“Experience Seekers” - The 20% of the market who want reliable coverage and network access. 45% of these choose MA plans.

“Provider First Shoppers” - The 40% of the market who prioritize marquee providers. 40% choose MA plans.

These characteristics reinforce the need for radically different targeting approaches to reach priority segments, a re-thinking of narrow networks, and plan benefits that complement the segment focus. And we have seen insurers follow suit, substantially increasing the number of plan options in more counties, every year.

How are Medicare Advantage plans evolving their benefit designs?

In its article, BCG advocates that Medicare Advantage plans should provide the “maximum benefits” in order to appeal to the broadest consumer segments. While this makes sense in a vacuum, not all plans have access to the same resources, brand presence, risk-based provider partners, Star Rating bonuses, and investor flexibility to submit identically rich plan designs to CMS. As a result, we can expect significantly different types of strategies and resulting benefit plan designs by each MA plan in each market across the US.

Based on the plans published by CMS on October 1, 2022, this variation is notable for the plans being purchased right now that will be effective on January 1. New 2023 offerings and approaches include Special Needs Plans (SNPs) targeted to specific conditions and dual-eligible members, Part B Premium “Give Back” plans that put pay members back a portion of their Part B Premium to CMS, community specific offerings (SCAN’s LGBTQ+ focused plan, for example) new and expanded MSBs (Medicare Supplemental Benefits), and out of pocket costs that have been shifted around in interesting ways in both HMOs and PPOs relative to 2022 offerings. All of these reflect important actuarial decisions that drive both growth and margin, and are rooted in assumptions about consumer behavior around the chess game being played among health insurers.

At the national level it is hard to really see this chess, but if you are an entrepreneur hoping to improve total cost of care patient outcomes by selling into MA plans, it is a MUST that you understand how these organizations run this aspect of their business. The easiest way to understand the plan design dynamics is to look at a local market example. That is why, in my next post, we will dive into one market to look at the competitive environment, the decisions that we now know were made, and hypothesize a few outcomes.

This market we will look at is a health care town unlike any other - Las Vegas.

https://www.cms.gov/files/document/nhe-projections-forecast-summary.pdf

https://www.commonwealthfund.org/publications/issue-briefs/2022/oct/traditional-medicare-or-advantage-how-older-americans-choose

https://www.bcg.com/publications/2022/understanding-customer-in-crowded-medicare-advantage-market